-

What to Expect from the Probate Process

The probate process is perhaps among the least understood aspects of estate planning. It can be complex and it may be a prolonged matter that takes months to complete. However, the steps of the process can actually be clearly defined. When you hire a probate lawyer serving The Woodlands, he or she will explain the probate process to you and answer any questions you may still have.

File the Petition

The first step in the probate process is to file a petition in probate court and provide notice to the heirs. If the individual died with a will, then the petition will seek to admit the will to probate and appoint the executor. If the individual died intestate, the petition will seek to appoint an administrator for the estate. All of the heirs and beneficiaries will be provided with notice and a notice about the probate hearing will usually be published in the local newspaper. This allows beneficiaries to voice objections in court.

Give Notice and Take Inventory

Once the executor is appointed by the court, he or she must notify all creditors of the estate. Creditors must make a claim within a certain period of time. Then, the executor will take an inventory of the estate property. The inventory includes real property, stocks, business interests, and other assets. The estate may need to hire an independent appraiser to assess the value of non-cash assets.

Pay Claims

The next step in the probate process is to pay claims. The executor will determine which claims against the estate are legitimate. Those will be paid and other expenses, such as funeral expenses, will be paid. It may be permitted to sell estate assets if this is necessary to pay these obligations.

Distribute Property

Once all legitimate claims have been satisfied and the waiting period to file claims has expired, the executor will ask the court for the authority to transfer the remaining assets. If the individual died with a will, the assets will be transferred in accordance with those specifications. If the individual died intestate, the assets will be transferred in accordance with the state intestate succession laws.

-

How Are Heirs Determined in Texas?

When a family member passes away, the surviving relatives must turn to a will or a probate court to determine how the deceased’s property should be distributed. To receive property, in the absence of a will, Texas probate law requires that you prove that you are a legitimate heir. To go through this process, it is often helpful to hire a probate lawyer in The Woodlands to assist with your case. Here is what you need to know about establishing yourself as an heir under Texas probate law.

Wills

A will is the most straightforward way to determine who is a legitimate heir. If there is a will in place, and no one contests it, then the will should state very clearly who the deceased intended to be an heir to his or her estate. If someone is not named as an heir in the will, then it is not possible to prove in court that he or she has a legitimate claim on being an heir without challenging the will. Challenging the will means proving that there is a legal reason it should not be considered binding.

Heirship Applications

If there is no will in place, then the estate will be decided in probate, and everyone who believes he or she should be considered an heir must file an application. Before heirship applications can be accepted, the potential heirs must establish that the deceased died without a complete will and that he or she had property in the state of Texas. There must also have been no administration of the estate, or, in cases where there was will, property must have been left out of the will. If these requirements are met, the applications for heirship can be submitted in a county in which the deceased owned property. The applications request information about the potential heirs and their relationships with the deceased. All potential heirs must sign the application, and if there are heirs that cannot be located, an ad must be placed in the paper to attempt to locate them. The court then uses this information to determine how to allocate the estate appropriately.

-

What to Know About a Probate Bond

When an individual goes to a probate lawyer to have a will drafted, the document will almost certainly waive the requirement of a probate bond . But in some cases, it is a requirement to obtain a probate bond in The Woodlands unless your probate lawyer successfully argues against it. When a probate bond is issued, its purpose is to offer protection to the heirs and creditors of the decedent specifically from the negligent or intentionally wrongful acts of the executor or administrator.

For example, an executor might decide to retain all of the funds in an estate for him- or herself instead of distributing them among the creditors and other heirs. The existence of a probate bond allows the creditors and heirs to recover the amounts they are entitled to despite this act of malfeasance. Although a probate bond seems to be desirable, in most situations it actually creates more problems than it solves. This is because obtaining a substantial probate bond can be costly and not everyone will be qualified to do so. The funds from the estate cannot be used to pay for the probate bond simply because these funds are inaccessible until the bond is already obtained.

-

Meeting with Your Probate Attorney

The probate process in The Woodlands is complex. It’s best to hire a probate lawyer to handle these complicated matters for your family. Taking a few minutes to prepare will help you get the most out of your meeting with the probate lawyer . For example, consider your answers to the following questions discussed in this featured video.

This legal professional suggests that your probate lawyer will ask you exactly which services you need him or her to perform. A probate attorney can prepare wills and living wills, revoke previous wills or trusts, and handle contested wills. You should also consider what your role in this matter is. For example, are you the executor or an heir? It’s also a good idea to prepare a list of questions you want to ask the attorney during your meeting.

-

Choosing an Executor for Your Will

When you visit a will attorney near Houston, you’ll need to make many more decisions than just figuring out how to divide your property after your death. You’ll also need to designate an executor of your will. The executor of a will has many important responsibilities, including gathering assets, assessing debts and other claims, paying taxes, and distributing the estate. It is largely a thankless job that requires careful attention to detail, persistence, and patience, so be sure to select an executor who is up to the task.

The Available Choices

Make a list of your available choices. Many people choose a close family member to be the executor of their will. Other possibilities include more distant relatives, friends, or professional executors. It is possible to choose more than one executor. These may be co-executors, who will share the responsibilities of the position. It’s a smart idea to choose one or more back-up executors in case the original executor is incapable of or chooses not to carry out these responsibilities.

The Individual’s Credentials

As you narrow down your list of possible executors, consider the credentials of each. It is helpful, though not required, for an executor of a will to have a legal background or a background in accounting. Failing this, it’s wise to choose someone who has earned a college degree, although this is not a mandatory requirement.

The Individual’s Age and Health

It’s necessary for your executor or back-up executor to outlive you. Consider the age and overall health of the individual you’re thinking of choosing. Of course, a generally healthy individual may later experience drastic medical setbacks that render him or her incapable of fulfilling the tasks of the role. When major life changes occur, you can revisit your executor designation and change it if need be. Changing your executor may also be necessary in the case of divorce or estrangement.

The Individual’s Personal Preferences

An executor of a will may face a long, tedious process. Many people simply don’t want the responsibility. When you’ve narrowed down your list to a few possibilities, approach these individuals and ask if they would be willing to be your executor, co-executor, or back-up executor.

-

What Probate Attorneys Do

Your family may want to speak with a probate attorney in The Woodlands after the passing of a loved one . A probate lawyer handles the administrative process of settling the decedent’s affairs. It’s commonly thought that probate is a lengthy and arduous process, but in fact, probate lawyers commonly succeed int making the process relatively easy for the surviving family members.

You can watch this video to hear a little more about what a probate attorney can do for your family. This legal professional explains that the probate lawyer may pay the decedent’s debts and taxes from his or her estate, take an inventory of the assets, and oversee the distribution of assets to the beneficiaries. Probate attorneys can also handle disputes among heirs regarding inherited property.

-

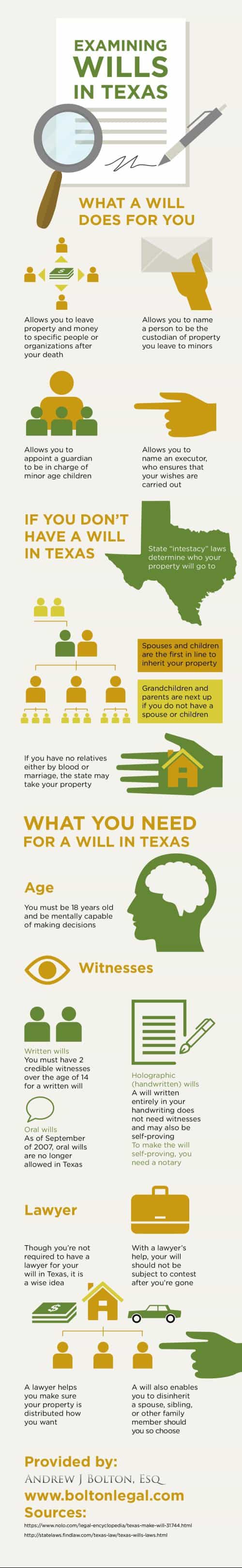

Examining Wills in Texas [Infographic]

If you’re like many people, chances are you don’t want to think about your own death. However, even if you are healthy now, accidents can happen and circumstances can change. That’s why it is a good idea to draft a living will in The Woodlands . A will is used after you pass away to distribute your property to family members, friends, organizations, or anyone else you so choose. If you do not have a will, Texas law dictates that your property will go to close relatives first. The property of a person without relatives through blood or marriage may be seized by the state. You can appoint an executor of a will, or a person who will make sure that it is carried out in the way you want. Take a look at this infographic to learn more about wills in Texas, including what you need to make a handwritten will legal. Please share with your friends and family.

-

How Is Child Support Determined?

Under the Texas Constitution, all parents have a legal obligation to support their children financially. According to family law in Texas, “a parent” refers to the child’s biological mother and a man who either signed a paternity acknowledgment, was married to the mother, or who has been otherwise legally determined to be the child’s biological father. Adoptive parents are also responsible for financially supporting their adopted children. Texas family law requires parents to support a child until he or she turns 18 years old, with some exceptions. Whichever parent does not have primary custody of the child is generally known as the obligor; and it is he or she who is obligated to pay child support. Child support rules are multi-faceted and so a family law attorney in The Woodlands is best able to help you estimate the amount you could be ordered to pay or receive.

Income

The income of the obligor is the most significant factor when calculating child support. In Texas, parents are required to submit to the court information about their gross income. If they are self-employed, they must submit their average monthly self-employment income, which is gross income less business expenses.

Deductions

Inform your child support lawyers of any deductions that the court should consider when calculating the amount of your payment. This may include health insurance premiums that you pay for your children. You may also be allowed to deduct court-ordered alimony or child support that you are already paying for a previous marriage and other children. When in doubt, let your attorney know what costs or expenses should be deducted, nothing should be left “off the table.”

Family Size

The amount of the child support payment will be adjusted depending on how many children must be supported. If you are paying child support for two children, the amount of the original payment is not doubled. Instead, the payment is increased by a certain percentage of your income.

Guideline Adjustments

Texas family court judges use family code guidelines when calculating the amount of child support to order. However, there are circumstances in which a judge will consider adjusting the support amount. The amount may be increased or decreased depending on the child’s age and needs, educational expenses, extraordinary healthcare expenses, and any other factors that speak to the best interests of the child.

-

Why You May Need a Living Trust

If you do not yet have a living trust , consider talking to a probate attorney near The Woodlands about whether this arrangement might benefit you. When you create a living trust, you can name yourself as the trustee to remain in full control of any assets you transfer into the trust. You can use the trust to pass on assets to your heirs after your death. One main benefit of having a probate attorney establish a living trust for you is that any property that remains in the trust at the time of your death will not go through the probate process. This means that if your heirs need financial resources right away after your passing, they can have access to them without waiting for the estate to be closed.

In some cases, it is more difficult to challenge a living trust than to challenge a will. If someone challenges the validity of a living trust, he or she would need to prove that you were mentally incompetent at the time the trust created or perhaps that your signature was forged. Generally, the fact that you continued to manage the trust after you created it is sufficient proof of your mental competence. However, be aware. There are often very good reasons not to create a trust for your properties. For example, the “taxable basis” of your trust property may be different than what it would be if the property were inherited in a simple probate case, so consult with a lawer prior to creating such an instrument without proper counsel.

-

Refusing to Sign Divorce Papers

In an uncontested divorce, both spouses may sign a divorce decree agreeing to the terms of the divorce, such as the division of property. Alternatively, one of the spouses may simply not oppose the terms set forth by the other spouse. Nevertheless, if one spouse refuses to sign-off on a divorce decree, then the divorce becomes a “contested divorce.” Regardless of whether you expect your divorce to be uncontested or contested, you should seek divorce advice from a family law attorney in The Woodlands. Divorce lawyers will handle your case for you, letting you move forward with your new life.

Will the Refusal Halt the Divorce?

It’s a common misconception that when one spouse refuses to sign the papers, the divorce is placed on indefinite hold. In fact, one spouse cannot hold the other “hostage” in the marriage by refusing to sign the paperwork. However, it does mean that it may take longer to finalize the divorce.

What Does It Mean to Set a Case for Hearing?

When a divorce is contested because one of the spouses refuses to sign the divorce decree, then the court will resolve the contested issues at trial. Your divorce lawyers will contact the clerk or administrator of the court to set a final hearing on the case. Shortly after setting a case for final hearing, the other party must be notified in writing of the hearing date and time. While awaiting the hearing, your divorce lawyers will conduct discovery, which is the process of obtaining information to be presented in court. This includes information about the marital assets, income, and similar issues. At court, each party has the opportunity to present evidence before the judge.

Should You Try Mediation?

Before the case goes to trial, there is still time to attempt to transition a contested divorce to an amicable divorce. Some court require mediation prior to any trial of your case. Even if a court does not require mediation, you might consider enlisting the help of a professional mediator, who is a neutral third party. Mediation can often help two parties with divergent goals and viewpoints find common ground. Mediators cannot force the parties to agree to anything. If mediation fails, then the case will go to trial.

RECENT POSTS

categories

- Uncategorized

- Estate Planning

- Probate

- Family Law

- Drafting a Will

- Divorce Lawyer

- Texas Family Law

- Divorce

- Real Estate

- Probate Court

- Child Custody

- Andrew J. Bolton

- Esq.

- Adoption

- Law Office of Andrew J. Bolton

- Wills

- Executor

- Infographic

- Guardianship

- Trusts

- Contested Divorce

- Child Support

- Attorney

- Living Wills

- Contested Will

- Prenuptial

- Probate Bond

- Heir Apparent

- Legacy Contact

- Living Trusts

- legal guardian

- Legal Disputes

- property rules

- Common Law

- Stocks

- Estate Tax