-

Creating a Will or Trust

Wills and trusts in the Woodlands dictate what happens to a person’s assets and estate after death. While most people refer to an attorney who helps in these situations as a will attorney or a probate lawyer, they are actually called estate-planning attorneys. When someone decides to create a will or a trust, consulting with a lawyer can ensure that he or she achieves certain estate-planning goals.

In this video, an attorney details the many benefits of working with a lawyer during the estate-planning process. As he explains, a lawyer understands the best avenues for allocating assets following death. For example, a lawyer can help explain when a trust or will is the most effective means to allocate assets to family members. Working with an attorney also ensures accurate preparation of documents, so as to ensure smooth probate and estate execution.

-

The Probate Process at a Glance

A probate court in the Woodlands handles the legal process that occurs once someone dies, including appraising the deceased person’s property and distributing property according to the will. Probate usually involves court appearances by a probate lawyer, who receives compensation from estate property. The process begins when the person named as executor to the will, or a person appointed by a judge, files paperwork with the local probate court.

During this time, the executor to the will must find, secure, and manage assets throughout the probate process, which can take several months to a year. Depending on the amount of the deceased’s debts, the executor may talk to a probate attorney about selling the real estate, securities, or property. In most states, family members can ask the court to release short-term funds during the proceedings to pay for necessary expenses. The court can then grant the executor permission to pay the debts and taxes before dividing the remainder according to the will. The last step of the probate process is transferring the property ownership to the new property owners.

-

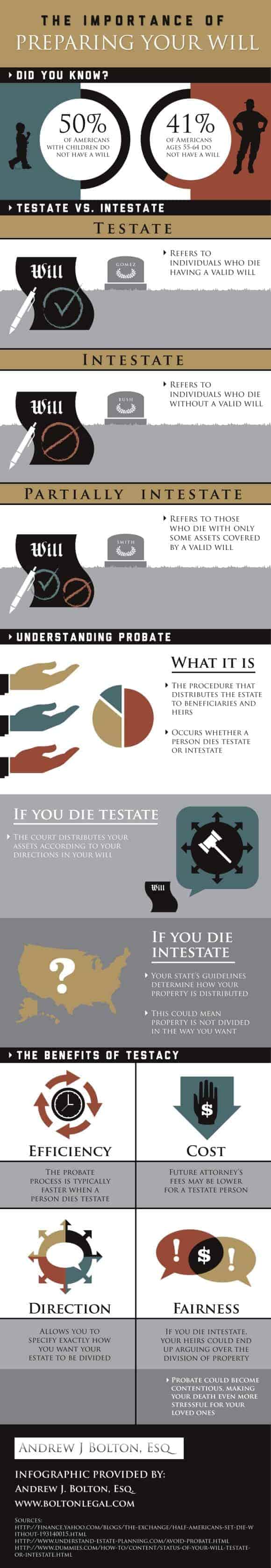

The Importance of Preparing Your Will [INFOGRAPHIC]

Did you know that at least half of Americans with children do not have a will? While thinking about passing away can be difficult, it’s important to take steps to make sure your family and loved ones are taken care of once you are gone. That’s why working with an experienced lawyer in estate planning in The Woodlands is so important. When a person dies testate, this means that he or she has a valid will. If a person dies intestate, there is no valid will, so property and assets are divided up according to state guidelines. Without a valid last will and testament, your property could end up being divided contrary to your wishes. Take a look at this infographic to understand the differences between being testate and intestate. Please share with your friends and family.

-

The Basics of Writing a Will

According to an AARP survey , two out of every five Americans over the age of 45 haven’t written a will. While many Americans may avoid this process because it entails actively planning for their demise, creating a will is one of the most important ways to plan for loved ones. Working with a probate and will attorney in the Woodlands allows someone to put his or her wishes on paper and help his or her heirs avoid unnecessary legal hassles.

What is a will?

A will is a legal document in which someone declares how and who will manage his or her estate after death. This estate can consist of big, expensive items like a vacation home as well as smaller items that hold sentimental value, like family photos. The person appointed to manage the estate is called the executor, as he or she is tasked with executing the testator’s wishes. However, there are certain types of property, like retirement accounts, that aren’t covered by wills. In such cases, the testator should discuss how to transfer ownership in this property with a will attorney. Creating a will also overlaps with other family law areas, as the testator can declare who will become guardian to his or her dependents in the will.Is an attorney necessary?

Contacting a law firm is not required to create a will. However, an experienced will lawyer provides useful advice on estate-planning strategies, such as how to create a living trust within a will. Whether someone decides to create his or her own will, or seeks the advice of a lawyer, he or she needs to consider all essential estate-planning documents. Indeed, this is a great time to research financial and health care powers of attorney.Should you create a joint will?

Will lawyers and estate planners tend to advise against joint wills. In fact, some states don’t even recognize them as legally valid. The problem in joint wills is that it is rare for both spouses to die at the same time. Additionally, many couples have property that is not jointly owned. Even though a couple’s separate wills may look similar, it’s recommended to just create separate legal documents. -

Fill in the blank Wills

Can I use a will from on-line or an office supply store? I never hear this question in my office. If my clients didn’t think a professional was necessary, they wouldn’t have scheduled an appointment to see me. However, this is the question I am most often asked outside my office, wherever people discover that I write wills. While almost everyone knows they should have a will, most people don’t. A form or store-bought will does seem like a cheap and easy alternative to an expensive lawyer. Nevertheless, my objection to such wills may be summed up in the words of a Taylor Swift song: “You don’t know what you don’t know.”

So, the quick answer to this question is that wills that promise they are “valid in all fifty states”, usually do, in fact, produce a will, which is valid in Texas. However, you may be letting your heirs in for a lot of heart ache if you actually use one.

There are five major reasons not to use prepackaged or fill-in-the-blank wills.

- It may easily end up costing more in the long run. Form wills often cost more to probate, and often take more of your (and your probate attorney’s) time. Texas has an unusual but effective probate process. A properly written Texas will is both quick and relatively inexpensive to probate. Those one-size-fits-all wills are often not written to take advantage of our Texas laws. Over the years, we have seen form wills from 11 different companies, including some of the most heavily advertised companies, and have yet to see a will which is written to take full advantage of Texas’s stream-lined probate system. In sum, having a valid will is not enough; it must also be the best will for probate proceedings in Texas.

- Your will may not say what you think it says. I have seen this in my practice when box wills are brought into me for revision. Do you know what “representation per stripes” means? If not, the extra money spent on a lawyer just make make a difference. A good example is a man with two children and three grandchildren. When interviewed, he wanted to split his property evenly between his two children. In the event one of his children died before him, he wanted the children of his dead child to inherit their parent’s share. He was unaware that, under the computer generated form he had had in place for the last several years, if one of his two sons died before him, the surviving child would inherit everything. Of course, with respect to the form wills that I have been asked to probate, I cannot tell my client whether or not the testator intended to disinherit his grandchildren, I can only tell them that he did.

- You probably have not thought of everything which should be addressed in your will, and most forms will not make the suggestions to you. The most common element left out of form wills is what should happen if a minor ends up inheriting property. Almost every will has at least some possibility that this will occur. Even if your children are grown, most people want their grandchildren to inherit if a child predeceases them. In that case, who will manage the money? Should it be the grandchild’s surviving parent? What if the surviving parent divorced your child, or if they were never married. Maybe you just don’t trust the other parent. At what age should the children/grandchildren come into their inheritance? What restrictions should be placed on the money? It is a rare eighteen year old capable of being responsible for more than one month’s living expenses. Any competent attorney will walk you through these questions and suggest solutions. Most form wills will not.

- When you see an attorney for a will, you usually get a lot more. By this, I mean a lot more documents. A power of attorney in particular is frequently needed in addition to any will, and, if you do not have one in place, it can cost your family thousands of dollars in fees and expenses for a guardianship proceeding.

- If you use an attorney, you have greater confidence that your will has been properly executed. This may seem like a very simple thing, but it ends up being a problem a lot more often than you would think. Not only must the witnesses be present when the will is signed, but the testator needs to be present when the witnesses sign. Also, people who inherit, cannot act as witnesses. The testator must state to the witnesses that he is signing a will. These issues and other have been used to hold an otherwise legal will, invalid. This is why most attorneys have wills signed in their offices, rather than sending a client home with an unsigned document.

As an aside, courts have also determine some fill-in-the-blank wills to be invalid holographic wills (wills written in the handwriting of the testator) and thus not subject to probate. If you have a fill-in-the-blank will for probate, we strongly urge you to have the assistance of counsel prior to attempting any probate.

Here is a good example of why you might want an attorney to assist you in drafting a will. Often, I have a client come in who owns a “special car,” and the client desires that a particular child inherit that special automobile. Drafted by himself, the will might plainly state: “To my son, John, I give my 1969 Corvette.” Well, the right 1969 big block Corvette can go for over $100K in the right market, so to compensate the client’s other kids for not getting the Corvette, the client then reduces the amount of other estate items that he gives John. Ten years down the road, however, the client makes a wonderful trade of that 1969 Corvette and gets a 1962 Ferrari in the deal. Now, he’s made a wonderful trade and John will be even happier, right? Wrong. Because the will mentioned a “Corvette” and not a “Ferrari,” John not only misses out on the Ferrari, but remember, the client reduced his share of the estate due to fantastic gift that he’s not going to be awarded. John gets less , not more. A properly drafted will might say: “I give to John most most valuable automobile at the time of my death.” Or perhaps, “I give to John my Corvette or any accession resulting from the disposal of that automobile.” Get a lawyer!

Oral Wills

In many states, a person can make an oral or “nuncupative” will under the proper circumstances. However, I will not delve deeply into that arena since Texas has outlawed oral wills since 2007. In sum, do not delay drafting a proper Texas will because gifts made orally will no longer be recognized in a Texas probate court. In such circumstances, you will have to settle for an family settlement agreement, if possible, or perhaps a proceeding to determine heirship.

In sum, if you are contemplating a probate of a fill-in-the-blank will, and you are concerned, there may be options or alternatives available. As noted, a Family Settlement Agreement (or FSA) might be appropriate, or, if the will is declared invalid, then a proceeding to determine heirship may be needed. At any rate, we stand ready to assist in all these areas.

-

“And to my worthless son the only thing I leave is . .

my Bible in the hope that he will one day actually open it.” Such wording is an example of what we call a nominal gift. And they are more common than you might think. Gifts are not usually a Bible; I more often see gifts of $1, or perhaps $100. Such provisions often appear for two reasons: The first is a desire on the part of the person making the will to get one last dig in at someone they dislike. More frequently, however, the reason is that the testator is following an attorney’s advice. In such cases, the concern is that if you make no mention of one of your children (known in probate lingo as the “objects of your affection”), then it could be argued that you accidently forgot them. This, in turn, would open up an avenue for a will contest. As noted, part of the legal requirements for being sufficiently competent to make a will include knowing “the natural objects of your affection.”

So if you are not competent enough to know who your children or spouse is, then you are likely not competent enough to make out a will. And if you have four children, and divide all your property among three of them, maybe you weren’t all that competent to begin with. So there are attorneys out there who, over the centuries, have advised their clients “Don’t completely disinherit a child, leave them something. How about $1?” In one stroke, you have thus proven that you know they exist, and it was not senility or error that caused them not to inherit. Personally, I am cocerned with nominal gifts, although I have written them when a client requested. I think nominal gifts put the executor in a difficult emotional situation, and obviously increases the possibility of a will contest. Lets look at three scenarios where the nominal gift causes problems.

In the first case, dad was furious with Leo and instructed his executor to give Leo one handful of dirt from the family homestead. The executor, Leo’s sister was actually on pretty good terms with Leo. Does she now have to actually give him a handful of dirt? Well, yes. She took an oath to the Court to uphold the will. So now she has to choose between hurting her brother’s feelings or dishonoring the will, the Probate Court, and her own oath. Oftentimes, in such cases, the heirs will enter into a family settlement agreement and override dad’s wishes anyways.

But more commonly, the executor does not want to give the nominal gift, because they do not want to cause potential problems. Bart has not kept in contact with his mother at all. In fact, if had not been for the nominal gift that suddenly arrived, he would never have known his mother died. But now he does know. And he knows there is a will submitted to the Court, which means an inventory is on file, and Bart is curious, so he gets a copy from the Court and wow! Bart had no idea mom was worth that much. If his mother had given him half, instead of leaving everything to his rotten sister, Lisa he would have gotten . . . enough to see an attorney over, anyway. And since Mom lived with Lisa the last 5 years of her life, he is going to argue the Lisa exercised undue influence over Mom. And suddenly Lisa is facing a will contest, all because she sent a nominal gift. But mom doesn’t want Bart to get half. Just be aware that nominal gifts invariably cause hard feelings and much litigation.

In a third scenario, Uncle Jesse tried to write his own will, and he left his daughter, Daisy $1. Not being a lawyer, Uncle Jesse he didn’t do a very good job of the will. He didn’t provide for an independent administration, which means the Court has to oversee everything. The executor, Luke, will now need a performance bond, and the probate will also cost much more. (There is a way around even this, if you can get the agreement of all the beneficiaries) But wait! Daisy was left $1. That makes her a beneficiary. And why should she agree to an independent administration? She’s going to want something to be agreeable. Uncle Jesse’s $1 gift just cost his heirs many thousands of dollars.

The argument against a nominal gift is even stronger now. On September 1, 2007, the Texas legislature passed Texas Probate Code 128A, which requires that the executor send a copy of the will to every beneficiary of the will within 60 days of the will being admitted to probate. Then the executor has to file an affidavit with the court listing the beneficiaries and the addresses, and swearing that the notices have all been sent. Even if a disinherited child is aware of their parent’s death, there is something about holding a copy of the actual will in your hands that makes you think of contesting it. After all, you already have it, you may as well take it to a lawyer and just see what they think.

I never advise in favor of a nominal gift. Not only are there the three arguments listed above against it, but there really is no reason for it. The legal concerns that cause some attorneys to advise client to leave their child $1, can be addressed in other ways. For example, you can put in a paragraph that says essentially. “I have deliberately made no provision for my son, Zorro. I have a good reason for this decision, and he is familiar with it.”

If you have questions regarding this, or another matter, please contact my office at 936-435-1908 or 281-723-2791 to schedule an appointment with an attorney.

Visiting this blog does not create an attorney-client relationship. Information should not be considered legal advice.

-

Destroy your old will

Many attorney-drafted wills state that all previous wills are revoked. Nevertheless, I advise my clients to physically destroy their old wills. It doesn’t really matter how you do it. You can tear it up, burn it, shred it, or even write “I revoke this will” on each page and sign it. The point is that you do some “physical act” to indicate that you have revoked your old will. You do not need to wait until your new will is drafted. If you would prefer Texas intestacy over the terms of your old will, destroy the old will immediately (please be sure that you understand Texas intestacy laws first). Texas is replete with cases where a will is accepted despite convincing testimony that the testator was in the process of replacing it.

The purpose of destroying an old will is to prevent someone else from attempting to probate that will in Court. You would be amazed to know how often old wills are submitted for probate. You should avoid giving out or making copies of your will. This is because if an original will cannot be located, a copy can be probated, along with testimony of what happened to the original, and a statement that the will was not, to the applicant’s knowledge, revoked. But once a copy of your will leaves your possession, then you can never again be sure that all the copies have been destroyed. Even if you ask your disinherited child for the copy of your old will back, and he gives it to you, he may have made additional copies in the meanwhile. There is no way to tell. The result? A potentially expensive fight in probate court.

In addition to destroying copies which you may have of an old will, you should advise the attorney who drafted that old will that you have made a new one (thus allowing them to destroy, or otherwise annotate the old will with an eye towards preventing an unnecessary will contest).

Similarly, you should avoid signing multiple original wills. If a will cannot be located, the presumption is that the testator destroyed the will, intending to revoke it, which can make the will which is located susceptible to challenge.

Just as a missing original will raises the presumption that it was destroyed by the testator, an undestroyed original will, raises the obvious presumption that it was not revoked. If you have more than one undestroyed will, you run the risk not only that someone will deliberately probate a will which you have revoked, but the risk that they will do so accidentally, or even be forced into probating it. It is especially important to destroy your old will where you have made dramatic changes to who inherits, or where you would prefer Texas intestacy to operate over the terms of your prior will. This is because a person who finds a will of a deceased person has an obligation to submit it to the Court, and if they do not do so, they can be called into Court to show why the will has not been submitted, and then can be ordered jailed until the will is submitted.

There have been multiple cases where someone told us that they had found an old will, but knew a more recent will had been written, but had been unable to find it. If an undestroyed, original will is in existence, it is difficult to persuade the Court that it was revoked.

If you would like to speak to an attorney about challenging a probated will, or replacing an existing will, please contact my office at 936-435-1908 for an appointment in Conroe, Huntsville or The Woodlands. Sugar Land or Stafford residents may call 281-723-2791.

When you write a new will, it is important to make sure that you destroy your old one!

-

Do I have to probate my mother’s will?

Probating a will accomplishes three basic ends. It transfers legal title to estate assets, such as real estate; it distributes property according to the wishes of the decedent; and it provides a vehicle for creditors to be paid. Where there are no debts, and if you are able to transfer legal title and distribute property without probating the will, there is perhaps no legal necessity that the will be probated. However,

all wills, whether probated or not, must still be filed with the court under Section 252.201 of the Texas Estates Code. Simply take the original will, and a copy of the death certificate to the county clerk and tell the clerk that you are filing the will under section 252.201. The clerk will take the will and provide you with a receipt. If the need for a probate soon becomes apparent, you now know where to find that will!

If you know of someone who is refusing to file a will under section 252.201, you may have them served by a constable and thereby called in front of a judge to explain why they have not filed the will. If they continue to refuse to file the will, the judge may order them to pay you all the costs of the suit, including attorney’s fees, and order the person incarcerated until the will has been filed.

A will which has been filed under Section 252.201 is a public record, and anyone may obtain a copy from the county clerk.

Moreover, there may be alternatives to formal probate available depending upon whether there are outstanding debts owed, and the amount of property involved. For example, there are Family Settlement Agreements which can serve in lieu of probate to address the distribution of assets outside of a formal probate proceeding (but they require universal agreement).

While there are some instances when probate may be unnecessary, please allow an attorney to assess the situation rather than just sitting on an unprobated will. Probating the estate of a loved one often gets harder, not easier, when it is delayed.

If you delay probating a will for too long, you may lose the ability to do so. If you delay and later find that that there’s a need to probate the will, then your delay will make things exponentially more costly. Moreover, if a will is not filed promptly, necessary witnesses may become harder to locate.

If you have any questions regarding this, or any other other legal topic, please contact our office at 936.435.1908 or 281-723-2791.

-

Family Settlement Agreement under Texas Law

A Family Settlement Agreement (FSA) is the term used for an agreement reached by all of the heirs as to how an estate should be distributed.

Oftentimes, an FSA is used to overcome the effects of a poorly drafted will. In other cases, it is somewhat like a magic wand for resolving probate disputes. There are few ills a properly drafted FSA cannot cure.

For instance, suppose a man dies with a second wife, but with children from his first wife. His will leaves everything to his children. The second wife claims a one-year family allowance, and the right to live in the man’s spacious and valuable home until she dies. She has that right, under Texas law. However,she is not really happy, because she knows she cannot afford to continue to live in the home, and would rather move near her own children, but if she did, she would have no place of her own to live. The children are not happy because the home is the most valuable asset of the estate, and they want to sell it now. Enter the family settlement agreement. The children and the wife can sit down together and agree that, in lieu of the family allowance and life estate, the wife can receive an annuity from the estate which would be sufficient to allow her to maintain a modest home near her own children. The children are now free to sell the home, use a portion of the proceeds to purchase the annuity, and distribute the entire estate.

A family settlement agreement is solid gold in probate court. The Court does not even have authority to approve or disapprove it. All the parties sign it, it is filed with the Court, and it acts both as a binding and enforceable contract. If properly drafted, it’s excellent protection against future liability and claims brought by heirs who spent their inheritance much faster than they ever thought they would (and now that they think about it, they really should have gotten more).

I have used family settlement agreements to quickly wrap-up cases that gave every indication of becoming nasty, protracted battles that would have made no one but me and the other lawyer happy. Actually, that is a myth. Most attorneys, myself included, hate cases where we can see our client is going to be unhappy at the other end, no matter how much money we might earn off their unhappiness. That is why I am such a fan of family settlement agreements. There is a much higher possibility that my client, and everyone else involved, will feel that justice was done.

Of course, all legal tactics, no matter how good, do have a downside. What are the downsides to a family settlement agreement?

- First, they require the agreement of ALL the heirs.

If you have one heir who is, for example, strung out on drugs, but living in his great aunt’s house, and not willing to do anything which would enable a sale of the home, the other 19 heirs cannot come together without him and sign a family settlement agreement. Instead, you will most likely end up with a dependent administration, where the judge may or may not allow you to take estate funds to make badly needed repairs before offering the house for sale, at a price which must first be approved by the judge, and in the meanwhile, you will need a bond, and will need a formal appraisal, and will need to file accountings and . . you get the idea. All for want of the signature of one miscreant with a 1/32 share of the estate.

- A second downside, is that if you give up something that you are clearly entitled to in a family settlement agreement, it may be seen as a gift for tax purposes.

A widow with a community estate worth 4 million cannot, for example, enter into a family settlement agreement with her children in which she changes her husband’s will to leave his half of the property directly to their children, thereby saving her heirs over $700,000 in taxes. Well, she can give her children one half of the property. And the court will allow it And it will be binding on her and the children. But it will not be binding on the IRS, and the taxes will still be owed. HOWEVER, if the same widow has a step child who was disinherited, and the will was made recently under circumstances which could arguably constitute undue influence then a reasonable agreement to surrender part of the inheritance to the step child most likely would be binding on the IRS, but that is going beyond the scope of this blog.

Suffice it to say, if you are probating or administering a taxable estate where the decedent did not invest in any tax planning, you will want to explore all your options.

All of this is not to say you should enter into a family settlement agreement in which your interests are not fairly represented. However, if you have an attorney, and a good idea of how the issue would come out, and what the costs might be without an agreement, they can not only save you a lot of money and time, but sometimes a family settlement agreement may also help you maintain a good, or at least a bearable, relationship with the other potential heirs. Or sometimes not.

In any case, you should have your own attorney review a proposed family settlement agreement before you sign. You may have rights you are not aware of.

If you would like to see an attorney to discuss a family settlment agreement, please contact my office:

Please call my Woodland office and set an appointment.

Visiting or reviewing this website does not create an attorney-client relationship.

-

I am considering a will contest

There are a number of avenues open to challenge a will. One of the most common challenge is to assert that a will was made under duress or undue influence. Undue influence means that there is an influence (usually another person) who overpowers or subverts that of the testator (the person making the will) and causes the testator to make a will which he would otherwise not have made. Duress seems to be somewhat self-explanatory. If a person signs any document under the fear that if she or she does not do so then physical harm may come to them–such a feeling can rightly be termed “duress.”

An example undue influence in the will making process would be a situation wherein Granny is checked into a nursing home by her children, who, visit frequently, but cannot provide the round the clock care which Granny requires. Four months later, Granny dies, and to everyone’s astonishment, her nurse, Florence, produces a will which leaves everything to her, a “relative” stranger.

Such a will may be relatively easy to overturn because of the presence of a close family, the short length of time Granny knew Florence, the large amounts of time Florence spent alone with Granny, and Granny’s physical dependence on Florence. But with the removal of any of these elements, a challenge becomes more difficult.

Moreover, some wills have a “no contest” clause which functions to disinherit or greatly diminish the award of any beneficary who contests a will. However, in the event of a successful challenge, the no contest provision is often voided along with the will. But making such a decision requires knowing all of the facts.

If you are considering a will contest, please contact Andrew J. Bolton, Attorney at Law, at 936-435-1908 or 281-723-2791 to schedule an appointment.

RECENT POSTS

categories

- Uncategorized

- Estate Planning

- Probate

- Family Law

- Drafting a Will

- Divorce Lawyer

- Texas Family Law

- Divorce

- Real Estate

- Probate Court

- Child Custody

- Andrew J. Bolton

- Esq.

- Adoption

- Law Office of Andrew J. Bolton

- Wills

- Executor

- Infographic

- Guardianship

- Trusts

- Contested Divorce

- Child Support

- Attorney

- Living Wills

- Contested Will

- Prenuptial

- Probate Bond

- Heir Apparent

- Legacy Contact

- Living Trusts

- legal guardian

- Legal Disputes

- property rules

- Common Law

- Stocks

- Estate Tax