-

Child Support Modification

Changes to child support modification suits. Commencing September 2018, the legislature changed the conditions for modifying a child support order. Under the previous scheme, a court could modify a child support agreement which deviated from the statutory guidelines set forth in the Texas Family Code, for any one of three reasons:

Reason #1: There has been a “material and substantial change in the circumstances of the child or person affected by the order” since the rendition of the original order.

Reason #2: The parents of the child have reached a mediated or collaborative law settlement which does not following the guidelines.

Reason #3: Within three years of the original order being rendered or last modified, the monthly child support payments deviate either 20 percent or $100 from the amount that would have been awarded under Code’s guidelines.

However, commencing September 1, 2018, the courts are now only be able to modify child support orders, even if agreed to, if “the circumstances of the child or person affected by the order materially and substantially changed.” This means that if proposed child support payments differ from Texas Family Code guidelines, then custodial parents will no longer be able to agree to an increase or decrease in child support payments without also showing that the circumstances of the child or a parent have “materially and substantially changed.”

-

How Is Child Support Determined?

Under the Texas Constitution, all parents have a legal obligation to support their children financially. According to family law in Texas, “a parent” refers to the child’s biological mother and a man who either signed a paternity acknowledgment, was married to the mother, or who has been otherwise legally determined to be the child’s biological father. Adoptive parents are also responsible for financially supporting their adopted children. Texas family law requires parents to support a child until he or she turns 18 years old, with some exceptions. Whichever parent does not have primary custody of the child is generally known as the obligor; and it is he or she who is obligated to pay child support. Child support rules are multi-faceted and so a family law attorney in The Woodlands is best able to help you estimate the amount you could be ordered to pay or receive.

Income

The income of the obligor is the most significant factor when calculating child support. In Texas, parents are required to submit to the court information about their gross income. If they are self-employed, they must submit their average monthly self-employment income, which is gross income less business expenses.

Deductions

Inform your child support lawyers of any deductions that the court should consider when calculating the amount of your payment. This may include health insurance premiums that you pay for your children. You may also be allowed to deduct court-ordered alimony or child support that you are already paying for a previous marriage and other children. When in doubt, let your attorney know what costs or expenses should be deducted, nothing should be left “off the table.”

Family Size

The amount of the child support payment will be adjusted depending on how many children must be supported. If you are paying child support for two children, the amount of the original payment is not doubled. Instead, the payment is increased by a certain percentage of your income.

Guideline Adjustments

Texas family court judges use family code guidelines when calculating the amount of child support to order. However, there are circumstances in which a judge will consider adjusting the support amount. The amount may be increased or decreased depending on the child’s age and needs, educational expenses, extraordinary healthcare expenses, and any other factors that speak to the best interests of the child.

-

When to Modify Child Support Agreements

During divorce proceedings, child support is usually one of the most contentious issues. While courts often invoke a “one size fits all” child support order, a competent attorney can request that a court consider a number of factors when awarding child support, including the age of the children and each party’s ability to pay. Moreover, it often becomes necessary to adjust child suppot in Conroe, TX when changes in need, or income, occur. When this happens, a family lawyer can help you file the correct paperwork and make your case for modification. Here are some of the circumstances that may make you eligible to change your child support agreement.

Short-Term Emergencies

Temporary child support modifications can be awarded to address short-term emergencies. Some of the circumstances that may make you eligible for this temporary modification including one parent being laid-off from work, or the child, or a parent, experiences a medical emergency. For instance, if you lost your job and cannot pay the same amount of child support, a court may temporarily adjust your payments until you start working again. But you must ask. Likewise, if you have custody of a child who has a medical emergency, you may request additional child support payments temporarily to help pay for treatment costs.Change in Income

Beginning in 2018, changes in income alone no longer will constitute a sufficient reason for a child support modification. Where there is a “material and substantial change” in the circumstances of a paying spouse, then that might form the basis for modification, but no longer is a mere increase in his or her salary sufficient.Change in Need

Child support agreements can be amended if a child has a change in his or her needs. For instance, he or she may have additional expenses associated with medical costs for a chronic condition or be entering college and need tuition money. A family lawyer can provide legal advice to help you determine if a permanent change in need exists that could make you eligible for a modification. -

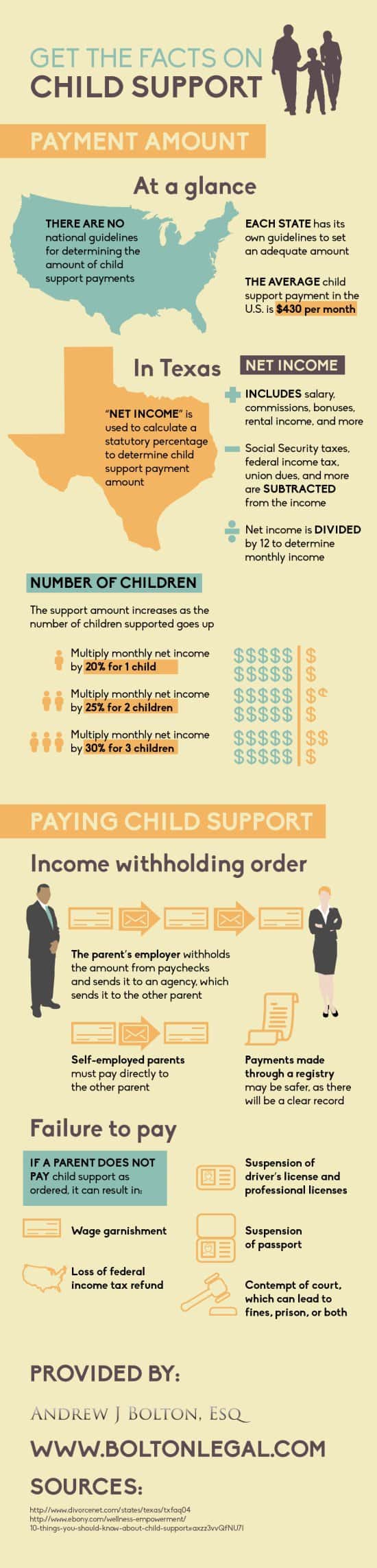

Get the Facts on Child Support [Infographic]

When you and your spouse are in the process of a divorce, it can be a stressful time for everyone involved. During matters of child custody near The Woodlands , the issue of child support payments will come up. There is no national standard for determining the amount of child support; rather, each state has its own guidelines to figure out what an adequate monthly payment may be. In Texas, child support is determined through figuring out the paying parent’s monthly “net income,” and then calculating a percentage that varies depending on how many children are being supported. Failure to pay child support can result in wage garnishment, suspension of driver’s license, and other consequences—even time in prison. Take a look at this infographic to get the facts about child support. Please share with your friends and family.

RECENT POSTS

categories

- Uncategorized

- Estate Planning

- Probate

- Family Law

- Drafting a Will

- Divorce Lawyer

- Texas Family Law

- Divorce

- Real Estate

- Probate Court

- Child Custody

- Andrew J. Bolton

- Esq.

- Adoption

- Law Office of Andrew J. Bolton

- Wills

- Executor

- Infographic

- Guardianship

- Trusts

- Contested Divorce

- Child Support

- Attorney

- Living Wills

- Contested Will

- Prenuptial

- Probate Bond

- Heir Apparent

- Legacy Contact

- Living Trusts

- legal guardian

- Legal Disputes

- property rules

- Common Law

- Stocks

- Estate Tax